Participate Of The Price Action On The Financial Market

With The Help Of An Truly Etablished CFD Online Broker House

We are a globally esteemed CFD online broker house that was founded in 2001.

A truly veteran of our cfd industry – no quest about it – no doubt! Back then, first establishing in Switzerland, we organized our own new since back then 2001, made strategic arrangements, and are as »ActivTrades« meanwhile at home in London (United Kingdom). From this prime location, it is more simple to meet the needs of vast markets including Europe, Asia, and/or South America. What is one main reason why we gained rapid global appeal. Since then, we have continued to expand and now have additional offices in Milan (Italy), Sofia (Bulgaria), Lisboa (Portugal), Brasil (Brazil), and/or and Nassau (Bahamas). For two decades now, we have been democratizing financial markets, with the help of CFDs, and offering professional financial services to clients all across the globe. We are a veteran of our cfd industry, which we also built. A pioneer in the retail CFD industry, if you will. With nearly 20 years of experience serving a global client base, we fully understand the assets, platforms and trading infrastructure required to create the ideal environment for investors and/or traders. Our clients benefit from this experience every day and this is why they place their trust in us. Because we continuously invest in our infrastructure, maintain the highest security standards, and partner with the most reputable financial institutions around the world to make sure that whatever happens our clients’ funds are protected. We have purchased, at no direct cost to clients, separate insurance protection to cover losses, if there is an insolvency event, in excess of 10.000,00 USD and up to 1.000.000,00 USD. We are regulated in multiple jurisdictions and are constantly striving to be compliant with the strictest international regulatory guidelines. All client accounts are ring-fenced from company funds by being held in segregated accounts with reputable, internationally recognised financial institutions; like Barclays, RBS, LLoyd`s, and/or Citibank. Our business practices are not only compliant with the highest regulatory standards, but our business also regularly undergoes financial audits by one of the Big Four accounting firms, PricewaterhouseCoopers (PwC). Because we are also a fully MiFID-compliant financial services institution, you can rest assured when investing and/or trading that your cfd online broker house of choice is always operating according to the law’s letter.

Many colleagues, as well as customers in particular, also attest to our good support.

Our customer service is provided 24/5 by telephone and/or fax to the UK office incl. by email. An online form for inquiries is also available as well as Live Chat. Our support is offered in 12 different languages. That’s why we got some awards such as Best Online Trading Service by ADVFN International Financial Awards, Best Customer Support by Agence IAT Grand Prize Excellence, and/or for example Best Customer Service by DKI & Euro am Sonntag. Besides, we were also crowned as Most Trusted Forex Broker by MENA Forex Show and/or Best Forex Broker by Le Fonti. Meanwhile we are providing more than 1000 CFDs on forex, bonds, commodities, equity indices, single equity shares, and/or crypto currencies, incl. different ETFs. Our clients can trade currency pairs with tight spreads from 0.5 pips and maximum leverage of 1:30. We are ensuring all clients’ invest and/or trades to be executed at the best available price and with no re-quotes. Our cfd online broker house doesn’t charge any commission on foreign exchange trading. Our execution is fully automated and void of any dealing desks, ensuring that there is no human intervention on clients’ trades. That’s why investing and/or trading with us, investing and/or trading with »ActivTrades«, is a gateway to major global indices around the world, including Nasdaq, Dow Jones, Euronext, FTSE, and many more. Investors and/or Traders can trade indices with spreads from 0.23 points. For commodity CFD investing and/or trading, spreads are presented as little as 0.005 points.

One of the most detailed features with us is the separate outlines for each market.

Forex, commodities, indices, and share has their overview, timetables, margin listings, and spread table. After registering for an account in »ActivTrades«, clients can choose a platform from three types that are provided, including ActivTrader, MetaTrader 4, and/or the MetaTrader 5. We designed the ActiveTrader platform to utilize the latest technology and advanced functionalities to create an immersive trading experience. All variants of platforms can be accessed by mobile, tablet, and desktop usage. There are many tools offered for use on the trading platform, including SmartOrder, SmartLines, SamartCalculator, SmartTemplate, SmartForecast, SmartPattern, and Pivot Points Indicator. With these tools, we can help you to have advanced investing and/or trading speed, precise execution with no, and ease clients’ identification in locating entry points for buy and sell orders. Trading education becomes a priority for us, at »ActivTrades«. There are many variants of education methods that investors and/or traders can choose. Besides a weekly webinar and ongoing seminars, we are also offering an updated economic calendar and consistent market analysis. Video tutorials on all of the tools and platforms are available without the need to register for a trading account, on our »ActivTrades« homepage. Furthermore, the personal one-on-one online training scheme provides a comprehensive learning experience tailored to suit each traders’ needs. Deposit and withdrawal requests can all be done from the trader’s area. We are accepting various payment options to fund including bank transfer, credit/debit card, Neteller, Skrill, PayPal, and Sofort. If we are not wrong, most clients choose us, choosed »ActivTrades«, because of our education and/or customer support. Our cfd online broker house is suitable for investors and/or traders who prioritize these two aspects. And has an FCA (United Kingdom) regulation that strengthens our reputation as a reliable broker.

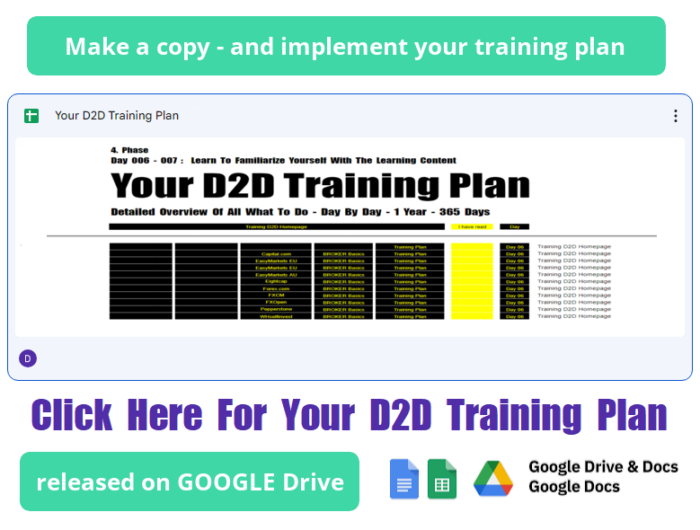

So focus on what you can influence. And trust your ability to make decisions by always deciding for yourself. And this is based on your competence, your feeling, or even your instinct. Instinct is your first thought. The feeling is what it feels like after the first thought. And competence is what you believe you know, knowing what you believe. So your third thought, your fourth thought, your fifth thought, your sixth, seventh, etc. etc. Your D2D training plan is designed for this: D2D Basics – to focus on what you can influence. And BROKER Basics – to teach yourself basic knowledge. This is where I see my function – to help you to help yourself – your benefit.

Damir Galić

better known as »Aaron«

Over the course of your life, you have probably often encountered situations in which you had to memorize theoretical knowledge within a certain amount of time. Whether at school or at university. I think that we can all tell numerous stories about ourselves. I have therefore set generous long-term deadlines for your training plan. So that on the one hand we don’t come under time pressure – and on the other hand we practice patience at the same time. Because I assume that you too, yes exactly you, are one of the more than 92% of people who earn their living not only on the financial market. What can be understood from a tax return, morally, formally, legally, monetarily. Most financial market participants have another main job in order to secure their livelihood. And not only that. Most of them also have a family – with whom you of course want to spend time. So that a deliberate, skillful self-organization (as hopefully learned in the D2D Basics by now) was and is the basis for the now desired broker basic knowledge.

During our time at school and/or at university, we were given deadlines before exams or class work, final papers and exams within which we had to prepare accordingly. But that’s not possible in our case! Because you won’t have to show anyone what you’ve read, analyzed and/or evaluated. No teacher, let alone professor, expects anything from you – my humble self included. Because you are making your D2D training plan for yourself. And not for my sake. But rather for your own sake. In order to then make even better trading decisions (buy/sell or do nothing) on the financial market with the help of CFDs. To increase the value of your CFD trading account even further. There are numerous ways to ease the process of learning your D2D training plan. With the help of the two main menus D2D Basics and Thats It or, above all, their submenu items, you should now stay motivated and learn best.

However, Your D2D Training Plan can be divided into 4 basic building blocks. I have truly given really, i mean really really serious thought to how I can organize everything for you in such a way that it is most sensible and simple for you to achieve practical, pragmatic learning success:

– Free pragmatic practical cardinal basic knowledge from this broker house

– Free pragmatic practical historical usefully learning webinars from this broker house

– Free pragmatic practical historical analyses about the daily business from this broker house

– Free historical editions of our usefully DEVISE 2 DAY Affiliate Financial Markets Online Newspaper

activtrades.com

ACTIVTRADES Learn To Trade

Analysis

01.01.01 Macro Analysis 2022 And/Or 2023

Take a whole calendar year to implement your D2D Training Plan! You cannot even begin to imagine today how much it will catapult your CFD trading, your understanding of WallStreet, to a higher and/or broader level. And that is especially true if you stick to your »Time Frame« and implement the lesson daily in a simple but detailed and clear manner. And you can do that every day – within just 1 hour. Especially if you have to pursue another full-time job every day to secure your own livelihood and that of your family, your one-year D2D Training Plan is more than useful for you. And that is regardless of whether you already see yourself as an experienced CFD veteran or are a beginner when it comes to WallStreet, especially CFDs. Therefore, use the opportunity that »ActivTrades« offers you, in the form of macro analyses, from 2023 and partly also 2022. So that you first become familiar with the basic overarching themes that move financial market prices. The learning content of »AvaTrade«, on the other hand, does not take the latest price actions into account at all. Here you will learn the basics, as in the individual lessons of »Capital.com«. Although some lessons are repeated, in terms of the learning content they complement each other on the whole. So you can assume that if you have implemented the lessons of »ActivTrades«, »AvaTrade« and/or »Capital.com«, you will have a basic knowledge of Wall Street, especially CFD trading. Which is why the webinars from »Dukascopy« build on this and are of use to everyone – even for you, yes, I mean you, exactly you, even if you have a different day job. Because the webinars of »Dukascopy« specifically address possible courses of action, with concrete examples of numerous methods. After the »Dukascopy« webinars, we’ll continue with basic knowledge from »EasyMarkets« – without going into the current and/or price action of the last few years. Before we then move on intensively with concrete, overarching analyses from »Eightcap« and/or »Instaforex«. This has the advantage that, on the one hand, you will gain basic knowledge thanks the learning content from »EasyMarkets«. And thanks to the learning content from »Eightcap« and/or »Instaforex«, you will also learn to better understand what drives financial market price actions basically, with the help of concrete historical analyses with concrete examples. And this will fundamentally strengthens your knowledge, so that from day to day, from lesson to lesson, you will become more and more confident, with both feet, and will raise your competence to a higher and broader level, as if by itself. This is why the focus on the basic learning content of »Plus500« and/or »XM«, especially with the focus on the MetaTrader trading platform, represents a super preliminary, well-rounded conclusion, which even are the D2D Broker Basics. So you can assume that if you implement all the lessons every day, day by day, you will definitely find yourself at a higher and broader level of competence. And that’s if you stick to your »Time Frame«, especially if you have another full-time job. Try it! You can’t even imagine today how well you would have organized your everyday life, including your CFD trading?

01.01.01 Macro Analysis 2022 And/Or 2023

01.01.01.01 Are we seeing a regime change in US equity markets?

01.01.01.02 How to use intermarket analysis in your trading

01.01.01.03 How to benefit from rate hikes as an investor?

01.01.01.04 What did we learn from Q3 earnings?

01.01.01.05 What does an inverted yield curve imply for markets?

01.01.01.06 What do I look at and why?

01.01.01.07 Stock Trading – Blue chips vs Penny stocks

01.01.01.08 Why should you use Dollar Cost Averaging in your strategy?

01.01.01.09 How does a profit warning impact your portfolio?

01.01.01.10 Is automated trading the right strategy for you?

01.01.01.11 Big Market Outlook 2023: What Investors need to be aware of

01.01.01.12 Stop-loss and Take-profit best practices

01.01.01.13 What matters for 2023

01.01.01.14 What’s happened to growth stocks?

01.01.01.15 Is it worth trading meme stocks?

01.01.01.16 What to expect from Q4 Earnings

01.01.01.17 How do dividends impact stock prices?

01.01.01.18 Why does this chart look attractive to me?

01.01.01.19 How to use company guidance in your trading?

01.01.01.20 A European Equity Renaisance?

01.01.01.21 Defense of the Realm

01.01.01.22 Introduction to Fibonacci Retracements

01.01.01.23 Screening out market noise

01.01.01.24 Algorithmic trading best practices

01.01.01.25 Should you invest in the luxury market?

01.01.01.26 Should you invest in the semiconductor market?

01.01.01.27 Swing Trading vs Position Trading

01.01.01.28 Should you invest in the tech market?

01.01.01.29 Should you invest in the health market?

01.01.01.30 How to invest in Orange Juice

01.01.01.31 How to invest in Coffee

01.01.01.32 How to reduce your trading fees

01.01.01.33 Physical Gold vs. Paper Gold: What’s Best?

01.01.01.34 Should you invest in the consumer discretionary sector?

01.01.01.35 Should you invest in the financial services sector?

01.01.01.36 Should you add alternative investments to your portfolio?

01.01.01.37 How to invest in silver

01.01.01.38 Consumer Discretionaries vs Consumer Staples

01.01.01.39 What are the most popular ratios to use in fundamentals?

01.01.01.40 Are you always winning in case of share buybacks?

01.01.01.41 How to invest in sugar

01.01.01.42 How to invest in the Bovespa Index (Ibovespa)

01.01.01.43 How to best take advantage of stock market sectors

01.01.01.44 When are the best moments to trade the Forex market?

01.01.01.45 Investing vs Trading – What’s best?

01.01.01.46 How to invest in the DAX 40 index?

01.01.01.47 Should you use short-selling in your trading?

01.01.01.48 How to invest in the CAC 40 index

01.01.01.49 How to get started with dividend investing

01.01.01.50 Understanding inflation, interest rates, and/or bonds

01.01.01.51 Why should you start with a demo account?

01.01.01.52 Top 4 Reasons to Close Your Trading Positions

01.01.01.53 Are You Addicted To Active Trading?

01.01.01.54 News Trading Best Practises

01.01.01.55 How to Efficiently Manage Stress in Trading

01.01.01.56 Why is patience key in active trading?

01.01.01.57 What Is Contrarian Trading?

01.01.01.58 Debt and Deficits Revisited

01.01.01.59 Margin Calls Explained: What Does It Mean?

01.01.01.60 How to trade triangles?

01.01.01.61 Can we expect a Santa Claus Rally in 2023?

01.01.01.62 Investing and Trading: The Role of Central Banks for you?

01.01.01.63 Should you anticipate rate cuts or a status quo in 2024?

Act rationally – without ignoring your instincts (first thought) and feelings (emotions based on them). And the best way to do this is with the help of 3 variables: No transaction without first defining the number of transactions, the entry and exit price including the stop price, or the position size of the transaction in % of the portfolio. Stick to it too! This is the essence, my essence (which I describe as 3 variables), especially in relation to derivatives trading, CFDs. Because this is the only way you can learn to organize your own money management. And that by defining the 3 variables in such a way that you can deal with them naturally. And then regardless of which scenario – i.e. price action – you believe you know, you know that you believe, you are acting (long or short).

Damir Galić

better known as »Aaron«

Find The Broker House That Suits You Best

Our cfd online broker house »ActivTrades« is rated above average on the numerous comparison sites on the Internet, that I have nothing to do with. To get to the point again about us, about »ActivTrades«, we are a cfd veteran, even forex broker, that is aimed at investors and/or traders from all around the world – the UK, Europe, Asia, and/or South America or Africa. We have been operating since 2001 – and are a proud veteran of the cfd industry,which we ourselves have more or less helped to shape. We allow clients to trade on the Forex market, CFDs on stocks, ETFs, and other instruments. In total, we have six types of assets available. And are headquartered in London, with additional offices in Milan (Italy), Sofia (Bulgaria), Lisboa (Portugal), Brasil (Brazil), and/or and Nassau (Bahamas). Our cfd online broker house operates under the law of the United Kingdom, the Bahamas, Luxemburgs, and/or Italy`s. During our tenure, of course, we have received enough awards – without wanting to focus on them. We are a cfd online broker house that has been providing services on the market for over 20 years. As »ActivTrades« we are focused primarily on active traders. But investors are also welcome – no doubt! But our most clients are cfd traders – not cfd investors. However, with more than 1.000 instruments and favorable investing and/or trading conditions (spreads from 0.5 pips) are offered, we also have practical instruments for passive investments, like ETFs. With us, there is no minimum deposit to activate your account at »ActivTrades«. Also the Demo Account is worth noting, if you want to have high-quality training for beginners. We regularly conduct webinars that are of interest to both novice investors and/or traders incl. experienced investors and/or traders clients who seek to improve their investing and/or trading skills. Therefore it goes without saying that we are offering clients individual and professional account types. For private investors and/or traders, we limit the leverage to a maximum of 1:30. Professionals can work with leverage up to 1:400. Traders who open a Professional account with 1:1 leverage and no swaps can trade CFDs on shares with a zero fee. Maybe that’s why is all in all also the reason why our clients decided for us – because we are a trusted cfd online broker house that is regulated by the FCA (in the United Kingdom) and/or SCB (in the Bahamas). For additional security of clients, our cfd online broker house also maintains deposit insurance up to 1.000.000 USD and protection against a negative balance. Because we are focused on different regions and have a wide audience of users from various countries.

Take One Hour A Day – 5 Days A Week

Either From Sunday To Thursday Or From Monday To Friday

30 Minutes To Study The Learning Content Of The BROKER Basics Autodidactically

30 Minutes To Study My Publishe Daily D2D Affiliate Financial Market Online Newspaper

You should generally take at least 1 hour to implement your D2D training plan on a daily basis in a meaningful and useful way. 2 hours a day is even better. But because the most financial market participants on Wall Street, on the financial market, also have other main professional activities (up to 8 hours per day), usually 1 hour should be enough. 30 minutes for your D2D training plan (to learn BROKER basics daily). And/Or also 30 minutes for my daily D2D Affiliate Financial Market Online Newspaper (to be up to date every day at the same time). During your self-taught BROKER Basics course, learn to write down the 3 crimonological questions – WHAT, WHY and/or HOW. Take your time. And follow through with your D2D training plan. From start to finish – in the order dictated by my humble self. All you have to do is fill out the templates (from GOOGLE Drive) in writing. And please do this after you have organized a new time frame and trading frame for yourself using the D2D Basics. I know that even though reading this text may be getting on your nerves at the moment. Or? But that’s because you instinctively emotionally rationally believe in knowledge, and/or know that you start to believing in it. That, that this is what I’ve been missing so far, since I was participating in the financial market, on WallStreet, with the help of CFDs! Because as written; I can empathize with you very well as an interested market guy. Who also has a family to look after and has a main job that lasts eight hours a day. And also wants to deal with WallStreet professionally. To earn a few dollars in a morally, legally and financially clean manner.

If you have learned to be honest with yourself, no one will be able to fool you anymore! How can any person fool you, yes you, if you don’t lie to yourself? Therefore, learn to speak to yourself – like to a good friend, like to your father, like to your son, like to God. And over time, the longer and more honestly you learn to communicate with yourself, you will not only become more self-confident – you will always understand yourself. No – you will also learn better and better who is (not) making a fool of you.

Damir Galić

better known as »Aaron«