Participate Of The Price Action On The Financial Market

With The Help Of An Truly Etablished CFD Online Broker House

For decades financial services have been operated by the rich, for the rich. That’s why we founded »Capital.com«, because we wanted to change this. Our mission was and is to disrupt traditional finance to make investing and/or trading more accessible. We set out to give people access to financial markets. From this simple idea emerged a revolution – a revolution led by ordinary people, taking the reins and making a difference to their lives, their financial futures and most importantly, the future of the world. So when retail investors and/or retail traders began rallying behind Tesla to help create one of the world’s most valuable companies, they weren’t just investing in a growth stock with revolutionary technology, they were investing in the promise of a better future – a more sustainable future. And while climate activists and politicians play their part, Tesla’s share price was the defining feature in an entire fossil-fuel run automotive industry going electric. And we, even »Capital.com«, has been right there all along, supporting and driving the retail-investor and/or retail-trader (r)evolution. We, from »Capital.com«, were founded in 2016. And have harnessed the power of technology to open up trading and investment options – in a way that would eradicate the old-fashioned and out-dated barriers to entry. Today, our global web- and app-based platform have meanwhile more than 400.000 open accounts in our quest to make a difference to their lives, their financial futures and/or the world.

Knowledge is Power – no doubt – no quest about it!

“We are not born investors, we become investors”. That was the simple message rooted in our minds when we began developing »Capital.com«. With the right support, anyone can learn to invest and/or to trade. To make financial markets accessible to everyone, regardless of their level of experience, we knew we had to help people learn how to trade. This is why education is central to our platform. One of the first things we did was develop a financial trading app, Investmate; a pocket guide to market and trading literacy. This was just the beginning. We now support investors and/or traders with a host of practical learning tools including a real-time demo account, rolling-news feeds, as well as more than 5.000 pages of financial content and analysis. While our YouTube trading channel is rethinking the way markets can be unpacked and explained for an entirely new generation, with up-to-the minute market insights, tutorials and multilingual explainers – giving our users the tools, strategies and confidence to trade. Today, our »Capital.com« is a global company with offices in Britain, Australia, Cyprus, Gibraltar, Poland, Bulgaria and Seychelles. In just a short period of time, we have become one of Europe’s fastest growing investment-trading platforms reporting triple-digit, year-on-year growth and a global team that has grown five-fold in just two years. But at the heart of it all, we are a business about people. Rooted in technology and innovation, we have built a platform to empower people to unleash their full potential. Whatever your motivation – be it to learn a new skill, grow your wealth or to hold corporations accountable to their actions – we are committed to helping you achieve your investing and/or trading goals. With access to over 3.000 world-renowned markets you can trade CFDs across the world’s most popular indices, commodities, shares and currency pairs. We promise you exceptional 24/7 customer service and transparent pricing with zero commission, no hidden fees, low overnight fees and competitive spreads.

Trade smart with Capital.com on TradingView platform

Connect your Capital.com account to TradingView and enjoy an unparalleled trading experience powered by exclusive charting tools. TradingView is a charting and trading platform that offers market analysis software to help you make informed trading decisions. It is also the most prominent trader and investor social network on the web with 50+ million users. TradingView has an intuitive interface, allowing you to take your trading to the next level, no matter where you are in your journey. TradingView is compatible with desktop, mobile and tablet devices, so you can pick and screen stocks and collaborate with other traders wherever and whenever you like. Bring consistency to your trading strategy with highly interactive and responsive mobile-friendly charts powered by 50+ smart drawing tools. Find an array of indicators right next to advanced screeners and your live news feed. There’s no need to switch platforms to trade effectively. Become a part of the trader and investor community and discover the latest market trends and insights. Spot potential opportunities using 12+ customisable charts, including Renko, Kagi, Point and figure, and view up to 8 of them on a single tab. Stay in sync with the markets with 12 alert conditions on price, indicators and strategies. Sharpen your judgement with 100+ pre-built indicators, countless community-built indicators, smart drawing tools, volume profile indicators, candlestick pattern recognition and more. Use 100+ of fundamental fields and ratios, financial statements, valuation analysis, and historical company data. Advanced trader? Create your own indicators using the platform’s powerful Pine ScriptTM programming language. Join a bustling community of like-minded people from all corners of the globe and chat in real-time. Watch and learn by tuning in to live trading streams, or share your knowledge by broadcasting your own. Create a Capital.com account in moments and connect to TradingView!

Losses are as much a part of making money as gains – like in any business (not only on financial markets). That’s why I always operate with my 3 variables. No transaction without first defining the number of transactions, the entry and exit price including the stop price, or the position size of the transaction in % of the portfolio. Stick to it too! This is the essence, my essence (which I describe as 3 variables), especially in relation to derivatives trading, CFDs. Because by defining the entry and exit price in advance (regardless of the timeline), you not only discipline yourself. No, you will always know what you can expect in terms of potential profit and/or loss as long as your transaction has not (yet) been completed.

Damir Galić

better known as »Aaron«

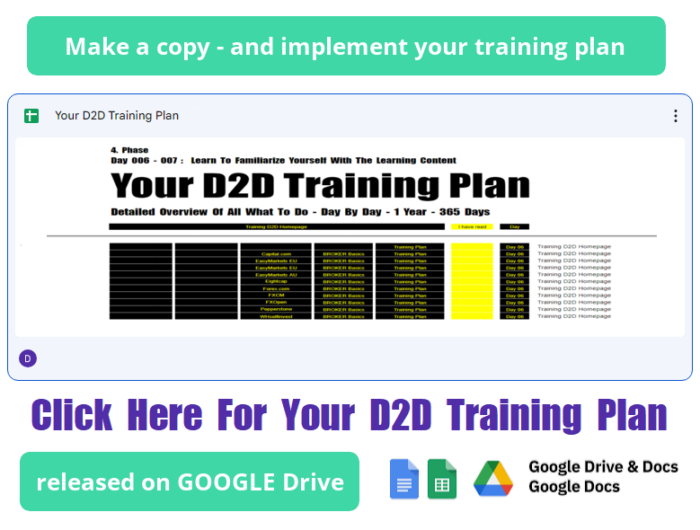

Over the course of your life, you have probably often encountered situations in which you had to memorize theoretical knowledge within a certain amount of time. Whether at school or at university. I think that we can all tell numerous stories about ourselves. I have therefore set generous long-term deadlines for your training plan. So that on the one hand we don’t come under time pressure – and on the other hand we practice patience at the same time. Because I assume that you too, yes exactly you, are one of the more than 92% of people who earn their living not only on the financial market. What can be understood from a tax return, morally, formally, legally, monetarily. Most financial market participants have another main job in order to secure their livelihood. And not only that. Most of them also have a family – with whom you of course want to spend time. So that a deliberate, skillful self-organization (as hopefully learned in the D2D Basics by now) was and is the basis for the now desired broker basic knowledge.

During our time at school and/or at university, we were given deadlines before exams or class work, final papers and exams within which we had to prepare accordingly. But that’s not possible in our case! Because you won’t have to show anyone what you’ve read, analyzed and/or evaluated. No teacher, let alone professor, expects anything from you – my humble self included. Because you are making your D2D training plan for yourself. And not for my sake. But rather for your own sake. In order to then make even better trading decisions (buy/sell or do nothing) on the financial market with the help of CFDs. To increase the value of your CFD trading account even further. There are numerous ways to ease the process of learning your D2D training plan. With the help of the two main menus D2D Basics and Thats It or, above all, their submenu items, you should now stay motivated and learn best.

capital.com

CAPITAL.COM Education

Education Hub

03.01.01 The Basics Of Trading

03.01.02.01 Introduction To Financial Markets

03.01.02.02 What Are Leverage And Margin?

03.01.02.03 Derivatives And Risks Of Trading

03.01.02.04 Financial Instruments

03.01.02.05 The ABCs Of Derivatives And CFDs

03.01.03.01 FX Trading Explained: How To Trade FX

03.01.03.02 Stock Trading Explained: How To Trade Stocks

03.01.03.03 Index Trading Explained: How To Trade Index

03.01.03.04 Commodities Explained: How To Trade Commodities

03.01.03.05 Cryptocurrencies: How To Trade Cryptocurrencies

03.01.04.01 Margin Trading

03.01.04.02 CFD Trading

03.01.04.03 ETF Trading

03.01.04.04 Trading Psychology Guide

03.01.04.05 Trading Strategy Guides

03.01.05 Technical Analysis

Take a whole calendar year to implement your D2D Training Plan! You cannot even begin to imagine today how much it will catapult your CFD trading, your understanding of WallStreet, to a higher and/or broader level. And that is especially true if you stick to your »Time Frame« and implement the lesson daily in a simple but detailed and clear manner. And you can do that every day – within just 1 hour. Especially if you have to pursue another full-time job every day to secure your own livelihood and that of your family, your one-year D2D Training Plan is more than useful for you. And that is regardless of whether you already see yourself as an experienced CFD veteran or are a beginner when it comes to WallStreet, especially CFDs. Therefore, use the opportunity that »ActivTrades« offers you, in the form of macro analyses, from 2023 and partly also 2022. So that you first become familiar with the basic overarching themes that move financial market prices. The learning content of »AvaTrade«, on the other hand, does not take the latest price actions into account at all. Here you will learn the basics, as in the individual lessons of »Capital.com«. Although some lessons are repeated, in terms of the learning content they complement each other on the whole. So you can assume that if you have implemented the lessons of »ActivTrades«, »AvaTrade« and/or »Capital.com«, you will have a basic knowledge of Wall Street, especially CFD trading. Which is why the webinars from »Dukascopy« build on this and are of use to everyone – even for you, yes, I mean you, exactly you, even if you have a different day job. Because the webinars of »Dukascopy« specifically address possible courses of action, with concrete examples of numerous methods. After the »Dukascopy« webinars, we’ll continue with basic knowledge from »EasyMarkets« – without going into the current and/or price action of the last few years. Before we then move on intensively with concrete, overarching analyses from »Eightcap« and/or »Instaforex«. This has the advantage that, on the one hand, you will gain basic knowledge thanks the learning content from »EasyMarkets«. And thanks to the learning content from »Eightcap« and/or »Instaforex«, you will also learn to better understand what drives financial market price actions basically, with the help of concrete historical analyses with concrete examples. And this will fundamentally strengthens your knowledge, so that from day to day, from lesson to lesson, you will become more and more confident, with both feet, and will raise your competence to a higher and broader level, as if by itself. This is why the focus on the basic learning content of »Plus500« and/or »XM«, especially with the focus on the MetaTrader trading platform, represents a super preliminary, well-rounded conclusion, which even are the D2D Broker Basics. So you can assume that if you implement all the lessons every day, day by day, you will definitely find yourself at a higher and broader level of competence. And that’s if you stick to your »Time Frame«, especially if you have another full-time job. Try it! You can’t even imagine today how well you would have organized your everyday life, including your CFD trading?

03.01.01 The Basics Of Trading

03.01.01.01 The basics of trading in 7 short bites

03.01.02.01 Learn How To Trade:

03.01.02.01 Introduction To Financial Markets

03.01.02.01.01 What is market liquidity?

03.01.02.01.02 Who are the main market players?

03.01.02.01.03 Stock market exchanges

03.01.02.01.04 Finance Quiz

03.01.02.02 Learn How To Trade:

03.01.02.02 What Are Leverage And Margin?

03.01.02.02.01 What are leverage and margin?

03.01.02.02.02 Getting started with margin trading

03.01.02.02.03 Using margin for different asset classes

03.01.02.02.04 Benefits and risks of margin trading

03.01.02.02.05 Margin call

03.01.02.03 Learn How To Trade:

03.01.02.03 Derivatives And Risks Of Trading

03.01.02.03.01 What are futures?

03.01.02.03.02 What are options?

03.01.02.03.03 What are credit default swaps?

03.01.02.03.04 What are asset-backed securities

03.01.02.03.05 What are forwards?

03.01.02.03.06 What are interest rate swaps (IRS)?

03.01.02.03.07 Risk and reward?

03.01.02.04 Learn How To Trade:

03.01.02.04 Financial Instruments

03.01.02.04.01 What is an IPO?

03.01.02.04.02 What are shares?

03.01.02.04.03 What are commodities?

03.01.02.04.04 What are indices?

03.01.02.04.05 What is forex?

03.01.02.05 Learn How To Trade:

03.01.02.05 The ABCs Of Derivatives And CFDs

03.01.02.05.01 What is a derivative?

03.01.02.05.02 Why buy derivatives?

03.01.02.05.03 Contract for difference

03.01.02.05.04 Financial Quiz

03.01.03.01 Guides To The

03.01.03.01 Markets You Can Trade

03.01.03.01 FX Trading Explained: How To Trade FX

03.01.03.01.01 Forex trading guide

03.01.03.01.02 10 strong currencies in the world

03.01.03.01.03 AUD/CAD

03.01.03.01.04 AUD/USD

03.01.03.01.05 CFDs on forex

03.01.03.01.06 EUR/AUD

03.01.03.01.07 EUR/CAD

03.01.03.01.08 EUR/CHF

03.01.03.01.09 EUR/GBP

03.01.03.01.10 EUR/JPY

03.01.03.01.11 EUR/USD

03.01.03.01.12 GBP/AUD

03.01.03.01.13 GBP/CAD

03.01.03.01.14 GBP/JPY

03.01.03.01.15 GBP/NZD

03.01.03.01.16 GBP/USD

03.01.03.01.17 Stocks vs forex

03.01.03.01.18 USD/CAD

03.01.03.01.19 USD/CHF

03.01.03.01.20 USD/JPY

03.01.03.01.21 What are lots in forex: Understanding lot sizes in forex

03.01.03.01.22 What is a swap in forex?

03.01.03.01.23 What is an order block in forex trading?

03.01.03.02 Guides To The

03.01.03.02 Markets You Can Trade

03.01.03.02 Stock Trading Explained: How To Trade Stocks

03.01.03.02.01 Shares trading guide

03.01.03.02.02 Advanced Micro Devices

03.01.03.02.03 Alibaba stock trading guide

03.01.03.02.04 Amazon stock trading guide

03.01.03.02.05 Apple

03.01.03.02.06 Aurora Cannabis

03.01.03.02.07 Barclays stock trading guide

03.01.03.02.08 BioNTech stock trading guide

03.01.03.02.09 BP stock trading guide

03.01.03.02.10 Canopy Growth

03.01.03.02.11 Coinbase stock trading guide

03.01.03.02.12 Disney stock trading guide

03.01.03.02.13 Google stock trading guide

03.01.03.02.14 Lloyds stock trading guide

03.01.03.02.15 Meta stock trading guide

03.01.03.02.16 Microsoft stock trading guide

03.01.03.02.17 Moderna stock trading guide

03.01.03.02.18 Netflix stock trading guide

03.01.03.02.19 NIO stock trading guide

03.01.03.02.20 Pfizer

03.01.03.02.21 Sainsbury’s stock trading guide

03.01.03.02.22 Tesla stock trading guide

03.01.03.02.23 Uber stock trading guide

03.01.03.02.24 Vodafone stock trading guide

03.01.03.02.25 X (Twitter) stock trading guide

03.01.03.03 Guides To The

03.01.03.03 Markets You Can Trade

03.01.03.03 Index Trading Explained: How To Trade Index

03.01.03.03.01 Indices trading guide

03.01.03.03.02 ASX 200

03.01.03.03.03 Dow Jones trading guide

03.01.03.03.04 France 40 index trading guide

03.01.03.03.05 FTSE MIB trading guide

03.01.03.03.06 Hang Seng trading guide

03.01.03.03.07 Japan 225 trading guide

03.01.03.03.08 S&P 500

03.01.03.03.09 Spain 35

03.01.03.03.10 UK 100 index trading guide

03.01.03.03.11 US Tech 100

03.01.03.03.12 VIX volatility index trading guide

03.01.03.03.13 What is the Germany 40 index and how to trade it?

03.01.03.04 Guides To The

03.01.03.04 Markets You Can Trade

03.01.03.04 Commodities Explained: How To Trade Commodities

03.01.03.04.01 Commodities trading guide

03.01.03.04.02 Brent Crude oil

03.01.03.04.03 Coffee

03.01.03.04.04 Copper

03.01.03.04.05 Crude Oil

03.01.03.04.06 Gold

03.01.03.04.07 Palladium

03.01.03.04.08 Platinum

03.01.03.04.09 Silver

03.01.03.04.10 US natural gas spot

03.01.03.05 Guides To The

03.01.03.05 Markets You Can Trade

03.01.03.05 Cryptocurrencies: How To Trade Cryptocurrencies

03.01.03.05.01 Crypto trading guide

03.01.03.05.02 Bitcoin

03.01.03.05.03 Bitcoin Cash

03.01.03.05.04 Bitcoin Gold

03.01.03.05.05 Bitcoin halving

03.01.03.05.06 Cardano

03.01.03.05.07 Crypto vs stocks: What’s the difference?

03.01.03.05.08 Dogecoin

03.01.03.05.09 EOS

03.01.03.05.10 Ethereum

03.01.03.05.11 Ethereum Classic

03.01.03.05.12 Litecoin

03.01.03.05.13 NEO

03.01.03.05.14 Polkadot

03.01.03.05.15 QTUM

03.01.03.05.16 Ripple

03.01.03.05.17 Shiba Inu

03.01.03.05.18 Steem

03.01.03.05.19 Stellar

03.01.03.05.20 TRON

03.01.04.01 Guides On How You Can Trade

03.01.04.01 – Margin Trading

03.01.04.01.01 The ultimate guide to margin trading

03.01.04.02 Guides On How You Can Trade

03.01.04.02 – CFD Trading

03.01.04.02.01 What is CFD trading and how does it work?

03.01.04.02.02 CFD markets

03.01.04.02.03 CFDs vs share trading

03.01.04.02.04 CFDs vs futures

03.01.04.02.05 CFDs vs. ETFs

03.01.04.02.06 CFDs vs forex

03.01.04.02.07 CFD trading strategies

03.01.04.02.08 CFD vs options

03.01.04.02.09 CFD hedging strategies

03.01.04.03 Guides On How You Can Trade

03.01.04.03 – ETF Trading

03.01.04.03.01 ETFs trading explained: How to trade ETFs

03.01.04.04 Guides On How You Can Trade

03.01.04.04 – Trading Psychology Guide

03.01.04.04.01 Overconfidence bias

03.01.04.04.02 Familiarity bias

03.01.04.04.03 Disposition effect

03.01.04.04.04 Loss aversion bias

03.01.04.04.05 Anchoring bias

03.01.04.04.06 Herd bias

03.01.04.04.07 Negativity bias

03.01.04.04.08 Hot-hand fallacy

03.01.04.04.09 Gambler`s fallacy bias

03.01.04.04.10 Confirmation bias

03.01.04.04.11 Self-attribution bias

03.01.04.04.12 Hindsight bias

03.01.04.04.13 Recency bias

03.01.04.04.14 Trading psychology: Emotions in trading

03.01.04.04.15 Trading psychology: Endowmnet effect

03.01.04.04.16 Trading psychology: Understanding Fear & Greed Index

03.01.04.05 Guides On How You Can Trade

03.01.04.05 – Trading Strategy Guides

03.01.04.05.01 Trading strategies guide

03.01.04.05.02 Day trading explained: How to day trade

03.01.04.05.03 Trend trading strategy

03.01.04.05.04 Position trading strategy

03.01.04.05.05 Swing trading strategy: An educational guide

03.01.04.05.06 Trading vs investing

03.01.05 Technical Analysis

03.01.05.01 RSI trading strategy: An educational guide

03.01.05.02 Bollinger Bands trading strategy: A comprehensive guide

03.01.05.03 Moving Average trading strategy: An educational guide

03.01.05.04 EMA trading strategy: An educational guide

03.01.05.05 Understanding MACD trading strategy: An educational guide

03.01.05.06 Fibonacci trading strategy

03.01.05.07 Head and shoulders chart pattern

03.01.05.08 Parabolic SAR trading strategy

03.01.05.09 Stochastic oscillator strategy

03.01.05.10 Support and resistance trading strategy (S&R)

03.01.05.11 Average Directional Index (ADX) trading strategy: A guide

03.01.05.12 Ichimoku Cloud trading strategy

03.01.05.13 What is Average True Range (ATR) trading strategy?

03.01.05.14 How to trade using Accumulation/Distribution line

03.01.05.15 Heikin-Ashi trading strategy: How to trade with Heikin-Ashi?

03.01.05.16 Accumulative Swing Index (ASI)

03.01.05.17 Arnaud Legoux Moving Average (ALMA) trading strategy

03.01.05.18 How to trade using McGinley Dynamic indicator

03.01.05.19 Hull Moving Average strategy: An educational guide

03.01.05.20 How to trade using Weighted Moving Average (WMA)

03.01.05.21 How to trade using Mass Index indicator

03.01.05.22 Candlestick patterns strategy

Go one step further and take the key interest rate into account – and/or also the exchange rate. And this is in line with the most important economic figures for each currency area (such as economic growth, the trade balance, inflation, the unemployment rate). So that the basic ratio of the various assets in your portfolio (cash, fixed-interest securities, and other CFDs) takes both current monetary policy and the economy into account.

Damir Galić

better known as »Aaron«

Find The Broker House That Suits You Best

We, from »Capital.com«, are one of Europe’s fastest-growing cfd online broker houses, investing and/or trading platforms, with offices across the UK, Europe and Australia. We keep our clients at the heart of every decision we make, facilitating their investing and/or trading with intuitive technology, in-depth education and dedicated support. Our mission is to help investors and/or traders make better decisions, by giving them the tools and resources they need to trade with confidence. It’s a mission that has won us multiple awards from leading industry authorities. With a growing number of offices across the globe, we’re proud to serve clients in 183 countries. Our global community of investors and/or traders have been responsible for $530+ billion in volume since our launch. Our friendly team is available around the clock, in 12 languages, to help you with any queries about your account. Investing and/or trading is a skill few people truly master. But we believe with the right combination of innovative technology, immersive education and unique insights into investing and/or trading behavior, anyone can build expertise in the markets. Whether you’re a seasoned investor and/or trader or just starting out, we’ll provide you with the tools you need to elevate your knowledge and skills. Built by investors and/or traders, we apply dedicated research, data science and unique insight to develop the products that energize our clients to improve. Our seamless user experience is driven by a relentless push to improve our platforms, with innovative, tech-first tools for confident trading and better decision-making. We, from »Capital.com«, strive to break down barriers to entry in investing and/or trading, providing some of the industry’s most competitive pricing along with clear and informative educational resources. Our global team combines decades of experience in investing and/or trading technology and knowhow, laying the groundwork for a user-friendly, tech-focused, and intuitive platform.

Take One Hour A Day – 5 Days A Week

Either From Sunday To Thursday Or From Monday To Friday

30 Minutes To Study The Learning Content Of The BROKER Basics Autodidactically

30 Minutes To Study My Publishe Daily D2D Affiliate Financial Market Online Newspaper

You should generally take at least 1 hour to implement your D2D training plan on a daily basis in a meaningful and useful way. 2 hours a day is even better. But because the most financial market participants on Wall Street, on the financial market, also have other main professional activities (up to 8 hours per day), usually 1 hour should be enough. 30 minutes for your D2D training plan (to learn BROKER basics daily). And/Or also 30 minutes for my daily D2D Affiliate Financial Market Online Newspaper (to be up to date every day at the same time). During your self-taught BROKER Basics course, learn to write down the 3 crimonological questions – WHAT, WHY and/or HOW. Take your time. And follow through with your D2D training plan. From start to finish – in the order dictated by my humble self. All you have to do is fill out the templates (from GOOGLE Drive) in writing. And please do this after you have organized a new time frame and trading frame for yourself using the D2D Basics. I know that even though reading this text may be getting on your nerves at the moment. Or? But that’s because you instinctively emotionally rationally believe in knowledge, and/or know that you start to believing in it. That, that this is what I’ve been missing so far, since I was participating in the financial market, on WallStreet, with the help of CFDs! Because as written; I can empathize with you very well as an interested market guy. Who also has a family to look after and has a main job that lasts eight hours a day. And also wants to deal with WallStreet professionally. To earn a few dollars in a morally, legally and financially clean manner.

Give space to those around you who are in charge and can’t do it better. And leave the room when it is (un)expressively clear to everyone involved that, looking back, it wasn’t any better. And that without understanding you as something better because you understood certain aspects of life better; let alone carry out certain activities more successfully. No – don’t imagine anything wrong. You always meet several times in your life. And then you may be in charge – in another place, at another time – and you may not do any better either.

Damir Galić

better known as »Aaron«