Participate Of The Price Action On The Financial Market

With The Help Of An Truly Etablished CFD Online Broker House

»XM« named of the XM Group is a group of regulated brokers and it is owned by Trading Point Holdings Ltd. Entities under XM Group have significant experience as financial services providers worldwide. The Trading Point of Financial Instruments Ltd was established in 2009 with a headquarter in Limassol, Cyprus. The Trading Point of Financial Instruments Pty Ltd was established in 2015 with a headquarter in Sydney, Australia. The XM Global Limited was established in 2017 with a headquarter in Belize. And/or the Trading Point MENA Limited was established in 2019 with a headquarter in Dubai. Under our XM Group, by the CySEC (Cyprus Securities and Exchange Commission) our Trading Point of Financial Instruments Ltd is regulated. Regulated by the FSC (Financial Services Commission) is our XM Global Limited. Regulated by the ASIC (Australian Securities and Investments Commission) is our Trading Point of Financial Instruments Pty Ltd. And/Or regulated by the DFSA (Dubai Financial Services Authority) is our Trading Point MENA Limited.

However, we, as »XM«, are meanwhile one of the more experienced cfd online broker houses, even cfd veterans, in the world of online forex brokerage today. Since our founding, we have experienced a lot of changes, including the addition of the Ultra-Low Account and EN Live Edu that are instructed by 16 global experts. In terms of trading instruments, we are a well-known diverse class assets provider, varying from Forex, Crypto, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, & Shares. We pride ourselves to be the ideal broker in investing and/or trading execution, offering a stat of 99.35% orders to be executed in less than 1 second. Investing and/or trading with us, with »XM«, would be also provided with a strict no requotes policy, no virtual dealer plug-in, no rejection of orders, real-time market execution, and the choice for investors and/or traders to place orders online or by phone. Spreads on all majors can reach as low as 0.6 pips in Ultra-Low Account, while spreads on other accounts usually start from 1 pip.

To protect our clients money, we have a clients fund in the event of extreme volatility, so that we can ensure each account type with Negative Balance Protection. Minimum deposit of 5 USD applies to Standard, Micro, and also Ultra-Low Accounts. Investors and/or traders who open accounts at us, with »XM«, are enabled in a condition similar to a Cent Account environment in the Micro Account, in which the Contract Size for every lot is only 1.000 units. If it is applied with the smallest lot size in the MetaTrader platform which amounts to 0.01, it means that investors and/or traders can go as small as 10 units per trade. For the deposit, we apply zero-fee deposits in most of its available payment methods. Investors and/or traders can choose to fund or withdraw their accounts via wire transfer, credit card, as well as the most favorable e-payment choices like Skrill, Neteller, and FasaPay. To give our clients the best experience in investing and/or trading, we have given access to both MT4 and MT5 platforms, each is available for more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android, and Android Tablet).

All in all, there is no doubt that we have gone global with our deep commitment to providing services in more than 30 different languages across the world. We, from »XM«, are outspokenly proud of our international connections – no doubt! Aside from easing investors and/or traders’ experience with mainstream trading platforms and high-quality trading execution, we are open to various types of investors and/or traders, from small capital traders to the more experienced ones with big deposits at the ready. Investors and/or traders are even provided with a Cent Trading environment should they choose to register under Micro Account. For our global approach, we, as »XM«, have ensured that investors and/or traders from various countries could access their service easily. This results in the provision of different domains specified for investors and/or traders in certain jurisdictions. With over 10.000.000 opened accounts since it was founded in 2009, we, from »XM«, has grown to a large and well established international investment firm and has become a true industry leader.

George Soros reflexivity theory states that investors make decisions based not on reality, but on their perception of reality. So based on reading, analyzing and evaluating the price action. Which in turn influences the price action through the resulting actions of all financial market participants (buy? sell? do nothing?) – etc. etc. How I love, enjoy and passionately read, analyze and evaluate this self-image – and build on it (not) act. Practice using the 3 variables every day: No transaction without first determining the number of transactions, defining the entry and exit price including the stop price, or the position size of the transaction in % of the portfolio. Because this is the only way you can manage your CFD trading like a professional. And then regardless of which scenario – i.e. price action – you believe you know, you know that you believe, you are acting (long or short).

Damir Galić

better known as »Aaron«

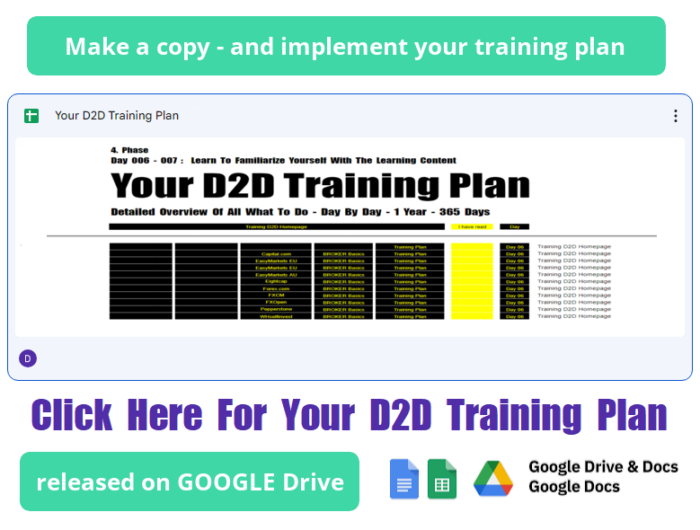

Over the course of your life, you have probably often encountered situations in which you had to memorize theoretical knowledge within a certain amount of time. Whether at school or at university. I think that we can all tell numerous stories about ourselves. I have therefore set generous long-term deadlines for your training plan. So that on the one hand we don’t come under time pressure – and on the other hand we practice patience at the same time. Because I assume that you too, yes exactly you, are one of the more than 92% of people who earn their living not only on the financial market. What can be understood from a tax return, morally, formally, legally, monetarily. Most financial market participants have another main job in order to secure their livelihood. And not only that. Most of them also have a family – with whom you of course want to spend time. So that a deliberate, skillful self-organization (as hopefully learned in the D2D Basics by now) was and is the basis for the now desired broker basic knowledge.

During our time at school and/or at university, we were given deadlines before exams or class work, final papers and exams within which we had to prepare accordingly. But that’s not possible in our case! Because you won’t have to show anyone what you’ve read, analyzed and/or evaluated. No teacher, let alone professor, expects anything from you – my humble self included. Because you are making your D2D training plan for yourself. And not for my sake. But rather for your own sake. In order to then make even better trading decisions (buy/sell or do nothing) on the financial market with the help of CFDs. To increase the value of your CFD trading account even further. There are numerous ways to ease the process of learning your D2D training plan. With the help of the two main menus D2D Basics and Thats It or, above all, their submenu items, you should now stay motivated and learn best.

xm.com

XM Research & Education

Learning Center

09.01.01.01 About This Video Series

09.01.01.02 Intro To The Markets

09.01.01.03 Trading Essentials

09.01.01.04 Fundamental Analysis

09.01.01.05 Technical Analysis

09.01.01.06 Money Management

09.01.01.07 Trading Psychology

09.01.01.08 Trading Strategies

09.01.01.09 More on Trading

09.01.02 Master MT4 With Our Video Tutorials

Take a whole calendar year to implement your D2D Training Plan! You cannot even begin to imagine today how much it will catapult your CFD trading, your understanding of WallStreet, to a higher and/or broader level. And that is especially true if you stick to your »Time Frame« and implement the lesson daily in a simple but detailed and clear manner. And you can do that every day – within just 1 hour. Especially if you have to pursue another full-time job every day to secure your own livelihood and that of your family, your one-year D2D Training Plan is more than useful for you. And that is regardless of whether you already see yourself as an experienced CFD veteran or are a beginner when it comes to WallStreet, especially CFDs. Therefore, use the opportunity that »ActivTrades« offers you, in the form of macro analyses, from 2023 and partly also 2022. So that you first become familiar with the basic overarching themes that move financial market prices. The learning content of »AvaTrade«, on the other hand, does not take the latest price actions into account at all. Here you will learn the basics, as in the individual lessons of »Capital.com«. Although some lessons are repeated, in terms of the learning content they complement each other on the whole. So you can assume that if you have implemented the lessons of »ActivTrades«, »AvaTrade« and/or »Capital.com«, you will have a basic knowledge of Wall Street, especially CFD trading. Which is why the webinars from »Dukascopy« build on this and are of use to everyone – even for you, yes, I mean you, exactly you, even if you have a different day job. Because the webinars of »Dukascopy« specifically address possible courses of action, with concrete examples of numerous methods. After the »Dukascopy« webinars, we’ll continue with basic knowledge from »EasyMarkets« – without going into the current and/or price action of the last few years. Before we then move on intensively with concrete, overarching analyses from »Eightcap« and/or »Instaforex«. This has the advantage that, on the one hand, you will gain basic knowledge thanks the learning content from »EasyMarkets«. And thanks to the learning content from »Eightcap« and/or »Instaforex«, you will also learn to better understand what drives financial market price actions basically, with the help of concrete historical analyses with concrete examples. And this will fundamentally strengthens your knowledge, so that from day to day, from lesson to lesson, you will become more and more confident, with both feet, and will raise your competence to a higher and broader level, as if by itself. This is why the focus on the basic learning content of »Plus500« and/or »XM«, especially with the focus on the MetaTrader trading platform, represents a super preliminary, well-rounded conclusion, which even are the D2D Broker Basics. So you can assume that if you implement all the lessons every day, day by day, you will definitely find yourself at a higher and broader level of competence. And that’s if you stick to your »Time Frame«, especially if you have another full-time job. Try it! You can’t even imagine today how well you would have organized your everyday life, including your CFD trading?

09.01.01.01 About This Video Series

09.01.01.01.01 Lesson 0.0 – About this Video Series

09.01.01.02 Intro To The Markets

09.01.01.02.01 Lesson 1.1 – Introduction to the Financial Markets

09.01.01.02.02 Lesson 1.2 – Introduction to Forex

09.01.01.02.03 Lesson 1.3 – Introduction to Shares

09.01.01.02.04 Lesson 1.4 – Introduction to CFDs

09.01.01.02.05 Lesson 1.5 – Introduction to Cryptocurrencies

09.01.01.03 Trading Essentials

09.01.01.03.01 Lesson 2.1 – Understanding Pips, Lots and Position Size

09.01.01.03.02 Lesson 2.2 – Understanding Leverage and Margin

09.01.01.03.03 Lesson 2.3 – Liquidity, Slippage and Swaps

09.01.01.04 Fundamental Analysis

09.01.01.04.01 Lesson 3.1 – Fundamental Analysis

09.01.01.04.02 Lesson 3.2 – Macroeconomic Analysis

09.01.01.04.03 Lesson 3.3 – Microeconomic Analysis

09.01.01.05 Technical Analysis

09.01.01.05.01 Lesson 4.1 – Principles of Technical Analysis

09.01.01.05.02 Lesson 4.2 – Chart Construction

09.01.01.05.03 Lesson 4.3 – Basic Bar and Candlestick Formations

09.01.01.05.04 Lesson 4.4 – Basic Concepts of Trends

09.01.01.05.05 Lesson 4.5 – Trend Lines and Channels

09.01.01.05.06 Lesson 4.6 A – Supports and Resistances

09.01.01.05.07 Lesson 4.6 B – Fibonacci for Support and Resistance

09.01.01.05.08 Lesson 4.7 – Trend Reversal Patterns

09.01.01.05.09 Lesson 4.8 – Major Continuation Patterns

09.01.01.05.10 Lesson 4.9 – Moving Averages and MACD

09.01.01.05.11 Lesson 4.10 – Momentum Oscillators

09.01.01.05.12 Lesson 4.11 – Oscillator Analysis

09.01.01.05.13 Lesson 4.12 – Volatility Indicators

09.01.01.05.14 Lesson 4.13 – Average Directional Index ADX

09.01.01.05.15 Lesson 4.14 – Ichimoku Kinko Hyo

098.01.01.05.16 Lesson 4.15 – Parabolic SAR

098.01.01.05.17 Lesson 4.16 – Avramis River Indicator

09.01.01.05.18 Lesson 4.17 – Other Charting Techniques

09.01.01.06 Money Management

09.01.01.06.01 Lesson 5.1 – Money Management

09.01.01.06.02 Lesson 5.2 – Risk, Reward and Expectancy

09.01.01.07 Trading Psychology

09.01.01.07.01 Lesson 6.1 – Trading Psychology

09.01.01.08 Trading Strategies

09.01.01.08.01 Lesson 7.0 – Filtering Entry Signals

09.01.01.08.02 Lesson 7.1 – Moving Average Ribbon Signals

09.01.01.08.03 Lesson 7.2 – Ichimoku Kinko Hyo Signals

09.01.01.08.04 Lesson 7.3 – ADX and Parabolic SAR Signals

09.01.01.08.05 Lesson 7.4 – Bollinger Bands Signals

09.01.01.08.06 Lesson 7.5 – Avramis River Signals

09.01.01.08.07 Lesson 7.6 – Combining Indicators

09.01.01.09 More on Trading

09.01.01.09.01 Lesson 8.0 – Trading the News

09.01.01.09.02 Lesson 8.1 – Elliott Wave Theory

09.01.01.09.03 Lesson 8.2 – Harmonic Patterns

09.01.01.09.04 Lesson 8.3 – Trader Evolution Stages

09.01.01.09.05 Lesson 8.4 – Algorithmic Trading

09.01.01.09.06 Lesson 8.5 – Trading Plan

09.01.02 Master MT4 With Our Video Tutorials

09.01.02.01 How to Open a Trading Account

09.01.02.02 How to Download, Install & Login to MT4

09.01.02.03 Market Watch / Standard Accounts

09.01.02.04 Market Watch / Micro Accounts

09.01.02.05 Chart Window Basics

09.01.02.06 Terminal Window Basics – Part 1

09.01.02.07 Terminal Window Basics – Part 2

09.01.02.08 Navigator Window Basics

09.01.02.09 Placing Orders in MT4

09.01.02.10 Account History Closed Trades

09.01.02.11 Market Watch in Detail

09.01.02.12 Managing Charts on MT4

09.01.02.13 Chart Window Properties

09.01.02.14 Indicators & Scripts

09.01.02.15 Set Profiles on MT4

09.01.02.16 Create Templates in MT4

09.01.02.17 Terminal Window Detailed

09.01.02.18 Installing Expert Advisors

09.01.02.19 Back Testing Expert Advisors

09.01.02.20 Customizing the MT4 Platform

09.01.02.21 Understanding Pending Orders

09.01.02.22 Placing Pending Orders in MT4

09.01.02.23 MT4 WebTrader Terminal

09.01.02.24 Trailing Stop in MT4

09.01.02.25 Stop Loss & Take Profit

09.01.02.26 MQL5 – Trading Signals

09.01.02.27 MT4 Multiterminal Window – Basics

09.01.02.28 Install MT4 iPhone App.

09.01.02.29 Using the MT4 iPhone App. (Part 1)

09.01.02.30 Using the MT4 iPhone App. (Part 2)

09.01.02.31 Using the MT4 iPhone App. (Part 3)

09.01.02.32 Install MT4 iPad App.

09.01.02.33 Using the MT4 iPad App. (Part 1)

09.01.02.34 Using the MT4 iPad App. (Part 2)

09.01.02.35 Using the MT4 iPad App. (Part 3)

09.01.02.36 Install MT4 Android Phone App.

09.01.02.37 Using the MT4 Android Phone App. (Part 1)

09.01.02.38 Using the MT4 Android Phone App. (Part 2)

09.01.02.39 Using the MT4 Android Phone App. (Part 3)

09.01.02.40 Install MT4 Android Tablet App.

09.01.02.41 Using the MT4 Android Tablet App. (Part 1)

09.01.02.42 Using the MT4 Android Tablet App. (Part 2)

09.01.02.43 Using the MT4 Android Tablet App. (Part 3)

So focus on what you can influence. And trust your ability to make decisions by always deciding for yourself. And this is based on your competence, your feeling, or even your instinct. Instinct is your first thought. The feeling is what it feels like after the first thought. And competence is what you believe you know, knowing what you believe. So your third thought, your fourth thought, your fifth thought, your sixth, seventh, etc. etc. Your D2D training plan is designed for this: D2D Basics – to focus on what you can influence. And BROKER Basics – to teach yourself basic knowledge. This is where I see my function – my help to help yourself – your benefit.

Damir Galić

better known as »Aaron«

Find The Broker House That Suits You Best

Our XM Group is one of the top brokers in the financial market, when it comes to CFD investing and/or trading. That’s who we are – what we are. Our Investing and/or trading conditions correspond to the average market; there are technical advantages that distinguish us, even»XM«, from other cfd online broker houses veterans. Our XM Group is a trustfully globally recognized broker, operational in nearly 190 countries and have counted more than 10.000.000 open accounts since we were established in 2009. We are offering around 700 instruments, including Forex pairs, stocks, commodities, cryptocurrencies, and precious metals. With licenses from regulators like ASIC and CySEC, who ensures you a secure investing and/or trading environment. Our company is committed to high-speed order execution without requotes, ensuring 99.35% of investments and/or trades are completed nearly instantly. Our broker’s leverage varies by region, offering up to 1:1000 for some non-EU countries while maintaining strict compliance with European standards for others. The spreads start from 0.6 pips. We don’t offer passive investment options like PAMM accounts but provide access to MQL5 copy trading and a VPS for algorithmic trading. We can be safely recommended to those cfd online broker house veterans who are interested in professional investing and/or trading with high order processing speed and optimal level of commission. The first thing worth noting is that we have licenses of four leading regulators in the world simultaneously. These are ASIC (Australia, ACN:164 367 113), FSC (Belize, 000261/397), CySEC (Cyprus, 120/10), DFSA (UAE, F003484). The second moment are our types of accounts. We, from »XM«, guarantee the same quality of execution for all types of accounts, which means a minimum of requotes, slippages and instant overlap of orders with counterparty counter transactions. The level of leverage complies with the European standards (including the MiFID directive that all CySEC licensees work in accordance with). There is an average market spread. The maximum leverage for clients registered under the EU regulated entity of the XM Group is 30:1. Attractive investing and/or trading conditions for novice investors and/or traders are also worth noting. The minimum deposit is 5 USD; there are cent (micro) accounts with a lot equal to 1.000 units. Thanks to our elaborated service and high-tech platforms, we are rightfully one of the cfd veterans, in the cfd online broker house industry – which we also helped to build, since 2009.

Take One Hour A Day – 5 Days A Week

Either From Sunday To Thursday Or From Monday To Friday

30 Minutes To Study The Learning Content Of The BROKER Basics Autodidactically

30 Minutes To Study My Publishe Daily D2D Affiliate Financial Market Online Newspaper

You should generally take at least 1 hour to implement your D2D training plan on a daily basis in a meaningful and useful way. 2 hours a day is even better. But because the most financial market participants on Wall Street, on the financial market, also have other main professional activities (up to 8 hours per day), usually 1 hour should be enough. 30 minutes for your D2D training plan (to learn BROKER basics daily). And/Or also 30 minutes for my daily D2D Affiliate Financial Market Online Newspaper (to be up to date every day at the same time). During your self-taught BROKER Basics course, learn to write down the 3 crimonological questions – WHAT, WHY and/or HOW. Take your time. And follow through with your D2D training plan. From start to finish – in the order dictated by my humble self. All you have to do is fill out the templates (from GOOGLE Drive) in writing. And please do this after you have organized a new time frame and trading frame for yourself using the D2D Basics. I know that even though reading this text may be getting on your nerves at the moment. Or? But that’s because you instinctively emotionally rationally believe in knowledge, and/or know that you start to believing in it. That, that this is what I’ve been missing so far, since I was participating in the financial market, on WallStreet, with the help of CFDs! Because as written; I can empathize with you very well as an interested market guy. Who also has a family to look after and has a main job that lasts eight hours a day. And also wants to deal with WallStreet professionally. To earn a few dollars in a morally, legally and financially clean manner.

Damir Galić

better known as »Aaron«