Participate Of The Price Action On The Financial Market

With The Help Of An Truly Etablished CFD Online Broker House

We, from »Plus500«, are an international cfd online broker house,

with our headquarter, in the United Kingdom, with our main offices located in the city of London.

Our company is authorized and regulated by the FCA. For investors and/or traders who are looking for a broker with a high regulation, »Plus500« can be the right choice. But that’s not the main reason why clients are choosing us. We also offer around 2.000 instruments to over 1.000.000 clients. And have an usefully long list of tradable forex currency pairs, stock market indices, cryptocurrencies, commodities, single stock shares, and/or ETFs. So that investors and/or traders can choose instruments suitable for their needs. Regardless, beginners should be extremely cautious while choosing their assets, as it can get daunting, and inherently risky. When investors and/or traders open an account at »Plus500« your money will hold traders’ funds on a segregated basis, following FCA’s client money rules. Investors and/or traders do not need to worry about us using their funds for hedging, as it is strictly prohibited to use clients’ funds for this purpose. Other advantages when you invest and/or trade your money with us, with »Plus500«, our spreads are tight and/or we have no commissions. Our company only offers a single type of account, but investors and/or traders can update the account from Retail to Professional by following some standards. To apply for a Professional Account, investors and/or traders have to fulfill at least 2 of the following 3 criteria eligible, such as sufficient trading activity in the last 12 months, financial instrument portfolio of over 500.000 Euro, and relevant experience in the financial services sector. We are well-regarded for our services through the market spread, leverage up to 1:30 for Retail Accounts, and leverage up to 1:300 for Professional Accounts. We try to give a sensible choice of leverage, which not only controls the risk but also helps novice investors and/or traders to exercise more control over their investing and/or trading emotions. Founded in 2008 already, we, from »Plus500«, provide almost the same features to both Retail and Professional accounts, including clients’ money protection, negative balance protection, best execution for orders, clear and transparent information, as well as financial services compensation scheme.

Usually we have around 39.000.000 USD positions opened, during an usual trading day – with usually more and/or less an average of 304.000 active involved accounts. That’s why we, from »Plus500«, always try to give the best services to our clients. One of the ways to reach our goals is by making clients feel confident in their investing and/or trading activity. That’s why we have a simple, but absolutely useful, pragmatic, practical, easy-to-use trading platform, with an especially well-designed mobile platform. Investors and/or traders can access our »Plus500« platform via web-trader, iPhone/iPad, and/or Mobile App. In our platform, investors and/or traders will get advanced tools such as stop limit, guaranteed stop, free email and push notifications on market events, and alerts on price movements. All of these tools can help investors and/or traders to navigate the financial market with a better understanding. That’s why I chose Plus500 – that’s why we are affiliate partners. Brothers in spirit if you will. As for payment methods, we, from »Plus500«, provide various choices like Visa or MasterCard, electronic wallets (PayPal and Skrill), and bank transfer (direct bank to bank funds transfer). For any concerns, troubles, or trading issues, investors and/or traders can contact our customer service that is available 24 hours a day and 7 days a week. Our official website of »Plus500« can be accessed in 24 languages.

Overall, we have some advantages and/or disadvantages! Who doesn’t? As it has a license from an elite regulator, investors and/or traders can feel safe when investing and/or trading with »Plus500«. We also provide a 24/7 support team to help investors and/or traders. But, offering leverages up to 1:300 is not suitable for high-risk investors and/or traders, such as scalpers, who indulge in high-frequency investing and/or trading that holds positions in the market for different time periods and typically use high leverage. Nevertheless, we think that our single account offering should generally be sufficient. Because you can also trade futures directly with us, directly with »Plus500«, if you want, also.

Of course, the price action always fluctuates highest in euphoria – since the majority of financial market participants have already bought and most of them expect even higher prices. Vice verca: price action always fluctuates lowest in panic – because the majority of financial market participants have already sold and most assume prices will be even lower. But when we act on such turning points can only ever be realized in retrospect. That is in the nature of things.

Damir Galić

better known as »Aaron«

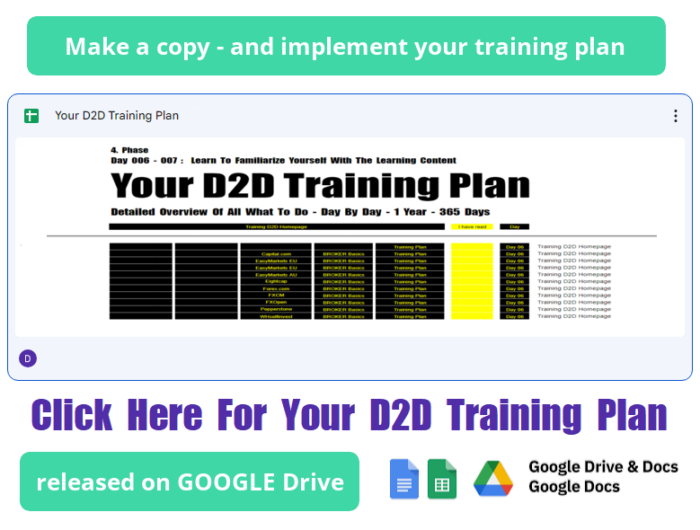

Over the course of your life, you have probably often encountered situations in which you had to memorize theoretical knowledge within a certain amount of time. Whether at school or at university. I think that we can all tell numerous stories about ourselves. I have therefore set generous long-term deadlines for your training plan. So that on the one hand we don’t come under time pressure – and on the other hand we practice patience at the same time. Because I assume that you too, yes exactly you, are one of the more than 92% of people who earn their living not only on the financial market. What can be understood from a tax return, morally, formally, legally, monetarily. Most financial market participants have another main job in order to secure their livelihood. And not only that. Most of them also have a family – with whom you of course want to spend time. So that a deliberate, skillful self-organization (as hopefully learned in the D2D Basics by now) was and is the basis for the now desired broker basic knowledge.

During our time at school and/or at university, we were given deadlines before exams or class work, final papers and exams within which we had to prepare accordingly. But that’s not possible in our case! Because you won’t have to show anyone what you’ve read, analyzed and/or evaluated. No teacher, let alone professor, expects anything from you – my humble self included. Because you are making your D2D training plan for yourself. And not for my sake. But rather for your own sake. In order to then make even better trading decisions (buy/sell or do nothing) on the financial market with the help of CFDs. To increase the value of your CFD trading account even further. There are numerous ways to ease the process of learning your D2D training plan. With the help of the two main menus D2D Basics and Thats It or, above all, their submenu items, you should now stay motivated and learn best.

plus500.com

PLUS500 Education

Trading Academy

08.01.01 Trader’s Guide

08.01.02.01 Trading Glossaries and Resources

08.01.02.02 Introduction to Trading

08.01.02.03 Psychological Aspects of Trading

08.01.02.04 Types of Trading

08.01.02.05 Trading Guide For Beginners

08.01.03 Trading Strategies And Techniques

08.01.04 Market Analysis And Forecasting

08.01.05 Risk Management And Trade Execution

Take a whole calendar year to implement your D2D Training Plan! You cannot even begin to imagine today how much it will catapult your CFD trading, your understanding of WallStreet, to a higher and/or broader level. And that is especially true if you stick to your »Time Frame« and implement the lesson daily in a simple but detailed and clear manner. And you can do that every day – within just 1 hour. Especially if you have to pursue another full-time job every day to secure your own livelihood and that of your family, your one-year D2D Training Plan is more than useful for you. And that is regardless of whether you already see yourself as an experienced CFD veteran or are a beginner when it comes to WallStreet, especially CFDs. Therefore, use the opportunity that »ActivTrades« offers you, in the form of macro analyses, from 2023 and partly also 2022. So that you first become familiar with the basic overarching themes that move financial market prices. The learning content of »AvaTrade«, on the other hand, does not take the latest price actions into account at all. Here you will learn the basics, as in the individual lessons of »Capital.com«. Although some lessons are repeated, in terms of the learning content they complement each other on the whole. So you can assume that if you have implemented the lessons of »ActivTrades«, »AvaTrade« and/or »Capital.com«, you will have a basic knowledge of Wall Street, especially CFD trading. Which is why the webinars from »Dukascopy« build on this and are of use to everyone – even for you, yes, I mean you, exactly you, even if you have a different day job. Because the webinars of »Dukascopy« specifically address possible courses of action, with concrete examples of numerous methods. After the »Dukascopy« webinars, we’ll continue with basic knowledge from »EasyMarkets« – without going into the current and/or price action of the last few years. Before we then move on intensively with concrete, overarching analyses from »Eightcap« and/or »Instaforex«. This has the advantage that, on the one hand, you will gain basic knowledge thanks the learning content from »EasyMarkets«. And thanks to the learning content from »Eightcap« and/or »Instaforex«, you will also learn to better understand what drives financial market price actions basically, with the help of concrete historical analyses with concrete examples. And this will fundamentally strengthens your knowledge, so that from day to day, from lesson to lesson, you will become more and more confident, with both feet, and will raise your competence to a higher and broader level, as if by itself. This is why the focus on the basic learning content of »Plus500« and/or »XM«, especially with the focus on the MetaTrader trading platform, represents a super preliminary, well-rounded conclusion, which even are the D2D Broker Basics. So you can assume that if you implement all the lessons every day, day by day, you will definitely find yourself at a higher and broader level of competence. And that’s if you stick to your »Time Frame«, especially if you have another full-time job. Try it! You can’t even imagine today how well you would have organized your everyday life, including your CFD trading?

08.01.01 Trader’s Guide

08.01.01.01 What is CFD Trading?

08.01.01.02 Slippage When Opening a Position

08.01.01.03 How to Trade With Plus500

08.01.01.04 Popular Trading Strategies

08.01.01.05 What is a Rollover?

08.01.01.06 What are Options?

08.01.01.07 What are Trading Alerts?

08.01.01.08 Margin Requirements

08.01.01.09 Slippage When Closing a Position

08.01.01.10 Understanding a Risk-Reward Ratio

08.01.01.11 Types of Trading Charts

08.01.01.12 How to Use +Insights When Trading

08.01.01.13 How to Trade Cryptocurrencies with Plus500

08.01.01.14 How to Trade Commodities with Plus500

08.01.01.15 How to Trade Forex CFDs with Plus500

08.01.02.01 Trading Guide for Beginners

08.01.02.01 – Trading Glossaries and Resources

08.01.02.01.01 Trading Terms Glossary for Beginners

08.01.02.01.02 30 Financial Terms Every Trader Should Know

08.01.02.01.03 Common Trading Terms Every Trader Should Know

08.01.02.02 Trading Guide for Beginners

08.01.02.02 – Introduction to Trading

08.01.02.02.01 Trading For Beginners: How to Start Trading

08.01.02.02.02 Trading Basics for Beginners

08.01.02.02.03 What Is Trading? Definition Guide For Trading

08.01.02.02.04 How to Choose a Trading Market

08.01.02.02.05 How to Practise Trading as a Beginner

08.01.02.02.06 What Is a Trading Plan and How Can I Create One?

08.01.02.02.07 Why You Should Consider Trading CFDs

08.01.02.02.08 What Is an Order in Trading?

08.01.02.02.09 Speculative Trading Explained: What Is Speculation?

08.01.02.02.10 Tading Guide for Beginners – Trading Analysis and Tools

08.01.02.02.11 Getting Started with Fundamental Analysis

08.01.02.02.12 Know the Basics: Technical Analysis for Beginners

08.01.02.02.13 Indicators Explained: What Are Trading Indicators?

08.01.02.02.14 Trading Charts Explained: How to Read Trading Charts

08.01.02.03 Trading Guide for Beginners

08.01.02.03 – Psychological Aspects of Trading

08.01.02.03.01 Trading Psychology & Behavioral Finances 101

08.01.02.03.02 Psychological Aspects of Trading Explained

08.01.02.03.03 Trading Mistakes Traders Make & How to Reduce Them

08.01.02.04 Trading Guide for Beginners

08.01.02.04 – Types of Trading

08.01.02.04.01 Forex Trading Fundamentals for Beginners

08.01.02.04.02 Guide to Commodity Trading for Beginners

08.01.02.04.03 Beginner’s Guide to CFD ETF Trading

08.01.02.04.04 How to Trade Stocks: Share CFD Trading for Beginners

08.01.02.04.05 A Beginners Guide to Day Trade: What Is Day Trading?

08.01.02.04.06 A Beginners Guide for Swing Traders: What Is It?

08.01.02.04.07 A Beginners Guide for Position Traders: What Is It?

08.01.02.04.08 Trading Styles Explained: Choosing Your Trading Style

08.01.02.04.09 Trading Derivative Markets: What Are Financial Derivatives?

08.01.02.05 Trading Guide For Beginners

08.01.02.05 – Trading And Other Financial Strategies

08.01.02.05.01 Trading vs. Investing: What’s the Difference?

08.01.02.05.02 Using Stop Orders: What Are Stop Orders in Trading?

08.01.02.05.03 Trading Rising and Falling Markets

08.01.02.05.04 Choosing Time Frames: How to Select a Trading Time Frame?

08.01.02.05.05 Managing Your Trading Risk: What Is Risk Management?

08.01.02.05.06 Long vs. Short Position: A Comprehensive Beginners Guide

08.01.02.05.07 Diversification: How To Diversify Your Trading Portfolio

08.01.03 Trading Strategies And Techniques

08.01.03.01 Using the Coppock Curve Indicator

08.01.03.02 Learning to Deal with Key Trading Mistakes

08.01.03.03 Making the Most of Trading a Range

08.01.03.04 Using the Relative Strength Index (RSI)

08.01.03.05 Trading Strategies: Binary and Zero Cost

08.01.03.06 Using Technical Analysis to Help You Trade Big Events

08.01.03.07 Choosing your Counter Currency

08.01.03.08 How to Identify the Bigger Technical Triggers

08.01.03.09 Using the Slow Stochastic Indicator in Commodity Markets

08.01.03.10 Support and Resistance Principles: Trading Indices

08.01.03.11 Building a Solid Foundation for Your Trading

08.01.03.12 Trading Head and Shoulders and Other Patterns

08.01.03.13 Using Fibonacci Extensions in Stock Markets

08.01.03.14 How to Use TA to Complement Your Trading

08.01.03.15 Getting the Most Out of Your Trading

08.01.04 Market Analysis And Forecasting

08.01.04.01 Trading Through Volatile Markets

08.01.04.02 Trading Economic Data

08.01.04.03 Market Volatility

08.01.04.04 Psychology of Short Term Trading

08.01.05 Risk Management And Trade Execution

08.01.05.01 How to Evaluate Your Trading

08.01.05.02 Handling the Emotions of a Trading Loss

08.01.05.03 Smoothing Out Your Trade Execution

08.01.05.04 Stop Loss Guidelines

08.01.05.05 Stop Loss Guidelines: Position Size Relative to Protection

08.01.05.06 Stop-Loss Guidelines: Not Too Far Away

08.01.05.07 Developing Your Execution Skills

08.01.05.08 Don’t Let Emotions Control Your Trading

08.01.05.09 Trailing a Stop-Loss

08.01.05.10 Trading When Markets Move Against You

08.01.05.11 Understanding How Mindset Can Impact Your Trading

That’s basically true! But the majority of stocks in the US, let alone the world, have not, in retrospect, risen above average in a historical context – if I’m not mistaken. So make rules for yourself and stick to them: If you don’t have success with your rules? Then change the rules! Such as: no transaction without first defining the number of transactions, the entry and exit price including the stop price, or even the position size of the transaction in % of the portfolio. Because with the help of these 3 variables, the current price action, every day, including today, becomes secondary for you. Because you will always know how much profit or loss you will realize if you stick to your rules, to your 3 self-determined variables. And this is independent of the daily price action.

Damir Galić

better known as »Aaron«

Find The Broker House That Suits You Best

We are a moderate-risk broker, how most others are describing us. We, from »Plus500«, understand ourselves as a reliable global forex broker, even cfd online broker house veteran, with a rich selection of assets and a client-centric approach to service delivery. We are proud of our offices and the fact that every interested human being can open an account at »Plus500« – if he and/or she wants it. What we understand as a democratized process to cultivate investing and/or trading in the world, also for private citizens who daily have to do another main job – and to leave the world a little better than we found it (as we did in 2008). Even if critics accuse us of promoting tax evasion because accounts can also be opened in so-called tax havens! That’s true – but everything is organized with political legitimacy from all the involved states. And therefore not morally reprehensible. Most of our clients are responsible individual human beings – active investors and/or active traders. Which we support, by providing them with risk management tools and proprietary platforms with excellent analytical capabilities. However, we as »Plus500«, are truly an international fintech holding that offers futures, forex, and or CFDs, incl. options worldwide through our network of branches. Our company was established in 2008, in Israel. It is regulated by the FCA (United Kingdom), as well as by 9 financial supervisory authorities in other countries, such as CySEC (Cyprus), ASIC (Australia), MAS (Singapore), FSCA (South Africa), among others. We are also listed as »Plus500« on the London Stock Exchange (ticker: PLUS) and are part of the companies that make up the FTSE 250 stock index. »Plus500« is meanwhile a reliable intermediary for accessing financial markets, used by over 25 million investors and/or traders worldwide, since 2008. We offer access to more than 2.000 instruments but specialize in CFDs and Forex. The choice of assets varies by country. For instance, only U.S. residents can trade futures, while UK residents are restricted from trading CFDs on cryptocurrencies. The company has already announced the Plus500 Invest service, allowing trading in real stocks rather than CFDs. However, its availability will vary across different countries. For more detailed information visit our »Plus500« homepage. And/Or contact us.

Take One Hour A Day – 5 Days A Week

Either From Sunday To Thursday Or From Monday To Friday

30 Minutes To Study The Learning Content Of The BROKER Basics Autodidactically

30 Minutes To Study My Publishe Daily D2D Affiliate Financial Market Online Newspaper

You should generally take at least 1 hour to implement your D2D training plan on a daily basis in a meaningful and useful way. 2 hours a day is even better. But because the most financial market participants on Wall Street, on the financial market, also have other main professional activities (up to 8 hours per day), usually 1 hour should be enough. 30 minutes for your D2D training plan (to learn BROKER basics daily). And/Or also 30 minutes for my daily D2D Affiliate Financial Market Online Newspaper (to be up to date every day at the same time). During your self-taught BROKER Basics course, learn to write down the 3 crimonological questions – WHAT, WHY and/or HOW. Take your time. And follow through with your D2D training plan. From start to finish – in the order dictated by my humble self. All you have to do is fill out the templates (from GOOGLE Drive) in writing. And please do this after you have organized a new time frame and trading frame for yourself using the D2D Basics. I know that even though reading this text may be getting on your nerves at the moment. Or? But that’s because you instinctively emotionally rationally believe in knowledge, and/or know that you start to believing in it. That, that this is what I’ve been missing so far, since I was participating in the financial market, on WallStreet, with the help of CFDs! Because as written; I can empathize with you very well as an interested market guy. Who also has a family to look after and has a main job that lasts eight hours a day. And also wants to deal with WallStreet professionally. To earn a few dollars in a morally, legally and financially clean manner.

Reading, analyzing and evaluating information in order to then make an action decision: Buy? Sell? Don’t act? is what I call daily business, in relation to our CFD Daily Business. Including money management – but that is a different topic. This quote has no bearing on the matter. Practice day-to-day business and become aware of the distortions between price action and any piece of information: whether central bank information? New economic data or company figures? Comparing one price action to another? Certain scenarios that have been put together and/or added together? As well as technical analysis? Because as George Soros tried to explain with his reflection theory: it is the distorted conclusions of all of us that always drive price action up too expensively or down too cheaply.

Damir Galić

better known as »Aaron«